Software Development Blog - FinTech

Recent Articles:

Creating a Finance App in 2025: The Development Guide

Financial Technology has a lot to offer when it comes to high-level financial optimization, advanced analytics and forecasting. Mobile app development is a particularly fertile FinTech niche to invest in. Nowadays, financial technology is becoming more and more popular and sought after. It is estimated that by 2024, global revenues from the FinTech sector will reach EUR 188 billion. Among other things, this is one of the main reasons why it is worth creating your own financial application and getting involved in the market. In this article, we will show you what a structured and transparent financial application development process looks like.

Security Best Practices for FinTech App Development

Creating an entirely new FinTech App is a complex, stressful and time-consuming challenge. These types of applications are used to manage all kinds of financial tasks, from transferring funds between bank accounts to issuing invoices, which results in increased cyberattacks and threats. This is mainly due to the large amount of personal details, private and sensitive data that is collected.

FULL ARTICLERevolutionizing Accounting with Web and Mobile Applications

The accounting industry has come a long way in terms of development over the years. What was previously known as solutions based on manual, paper-based record keeping and bookkeeping are steadily being replaced by digital tools. Today's accountants are now taking advantage of modern technologies in the form of mobile and web applications to improve efficiency, streamline the accounting processes they carry out and, most importantly, have constant access to real-time data.

FULL ARTICLEHow to Build FinTech Software Development Team

The FinTech sector, despite economic and regulatory challenges, is constantly growing in market value. Newly emerging financial technology companies and startups are introducing new, progressive solutions to the financial industry, mainly for this reason. Since you are here, you probably have your own idea for a business, and all you need is not only advanced technology, but above all, a talented development team!

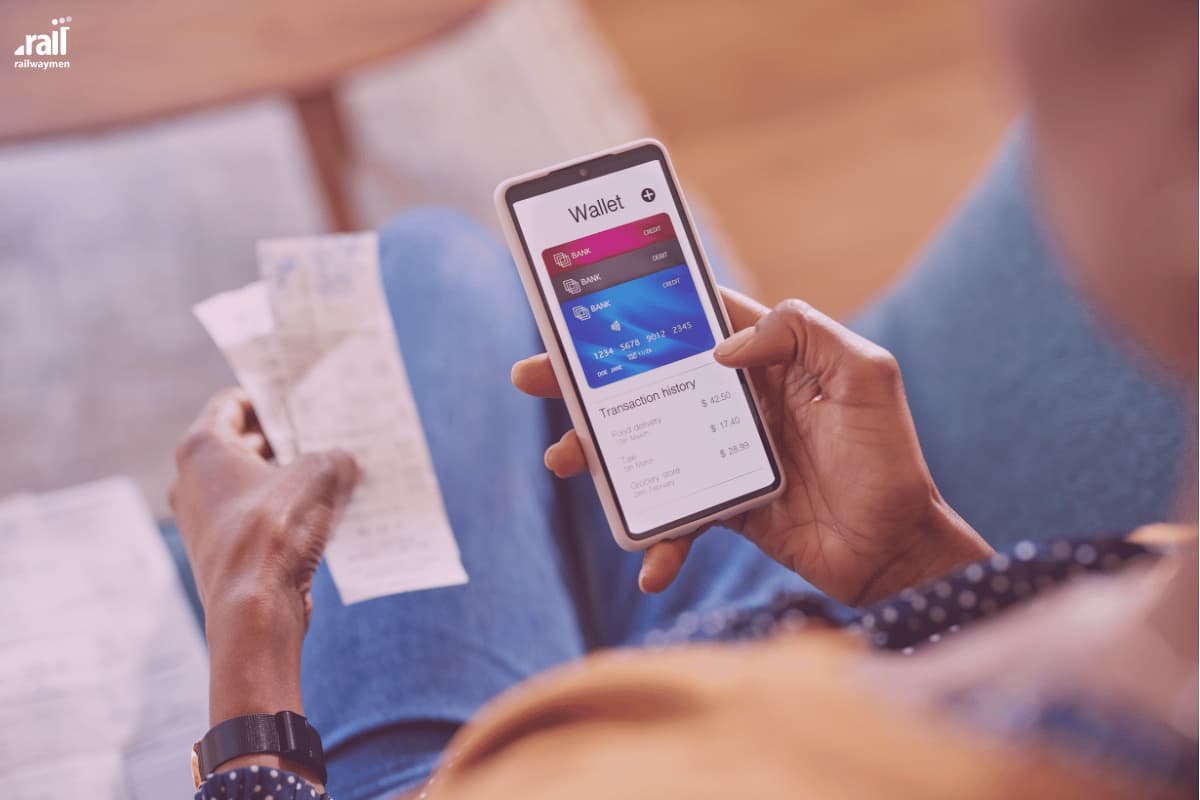

FULL ARTICLEHow to Make a Digital Wallet App: Key Tips that Guide You Through

There are many ways to conduct online transactions these days. Nowadays, we all meet financial solutions such as online banks, credit and debit cards, cryptocurrencies and digital wallets.

FULL ARTICLEHow to Build a Stock Trading App: Step by Step

Nowadays, digital platforms for stock traders aid in the automation of many processes, the improvement of accuracy, and the refinement of trading strategies. Creating a custom stock trading platform provides modern solutions for gathering and analyzing large amounts of data in order to gain valuable insights.

FULL ARTICLEABCD Finance Explained: From AI to Data Strategy

FinTech, also known as financial technology, has revolutionized banking and modern finance. The definition of FinTech includes all innovative technologies that are used to improve and automate financial transactions. These include simple applications for mobile payments, as well as more complex technologies such as cryptocurrencies or blockchain.

FULL ARTICLEFinTech & Big Data - Impact of Modern Solutions on the Finance

The demand for big data in the FinTech industry is noticeably growing. Big Data has pioneered many innovations in the financial technology sector, including open banking, a system that provides third parties with access to financial data via application programming interfaces (APIs).

FULL ARTICLEEnhancing financial management: Benefits of Xero integration

With regard to a company's growth, it frequently appears that it has a variety of systems and applications that do not effectively communicate with one another. One of the biggest issues in this field is accounting. Fortunately, there are tools available that can help streamline the process of managing finances. Among them is Xero, a tool that more and more FinTech companies are reaching for. What is Xero used for and what benefits does it generate for companies?

FULL ARTICLEThe Impact of FinTech on the Global Economy

Financial Technology, also known as FinTech, is considered as a potential key to the global ascendancy of finance and the digital economy is a new driving force in the sustainable development and high-quality growth of the global's economy.

FULL ARTICLE