Software Development Blog - FinTech

Recent Articles:

The Intersection of FinTech and Insurtech: An Emerging Market

The convergence of financial technology (FinTech) and insurance technology (InsurTech) has helped transform the broader financial services industry. The pace of these transformations was accelerated by technological advances, which led to the combination of these two service industries gaining widespread attention. Over time, this out-of-the-box mix began to reveal its potential for innovation and growth, which translated into a range of new opportunities.

FULL ARTICLEGuide to Selecting the Right FinTech Development Partner

FinTech companies in recent years have become the initiators of change in the financial sector. They are credited with revolutionizing the transformation of traditional banking and financial services. In an effort to remain competitive, these companies are choosing to partner with entities that are developing modern solutions that advance modern finance. All of this is done in order to get as close as possible to the customer and, at the same time, respond to their current needs.

FULL ARTICLEThe Role of FinTech in Sustainable and Green Finance

Recently, there has been a growing recognition of the urgent need to address climate change and promote sustainable development on a global scale. Governments, businesses, and individuals alike are increasingly embracing the concept of sustainability, seeking innovative solutions to mitigate environmental risks and create a more equitable and resilient future. In this endeavor, financial technology, has emerged as a powerful tool driving the transformation towards sustainable and green finance.

FULL ARTICLEImplementing Blockchain-based Solutions for KYC/AML Compliance

While technological development and globalization have helped corporate operations, money laundering and other digital financial crimes have also benefited from these developments. More than 2% to 5% of the world's GDP, or between $800 billion to $2 trillion in a single year, is thought to be laundered internationally.

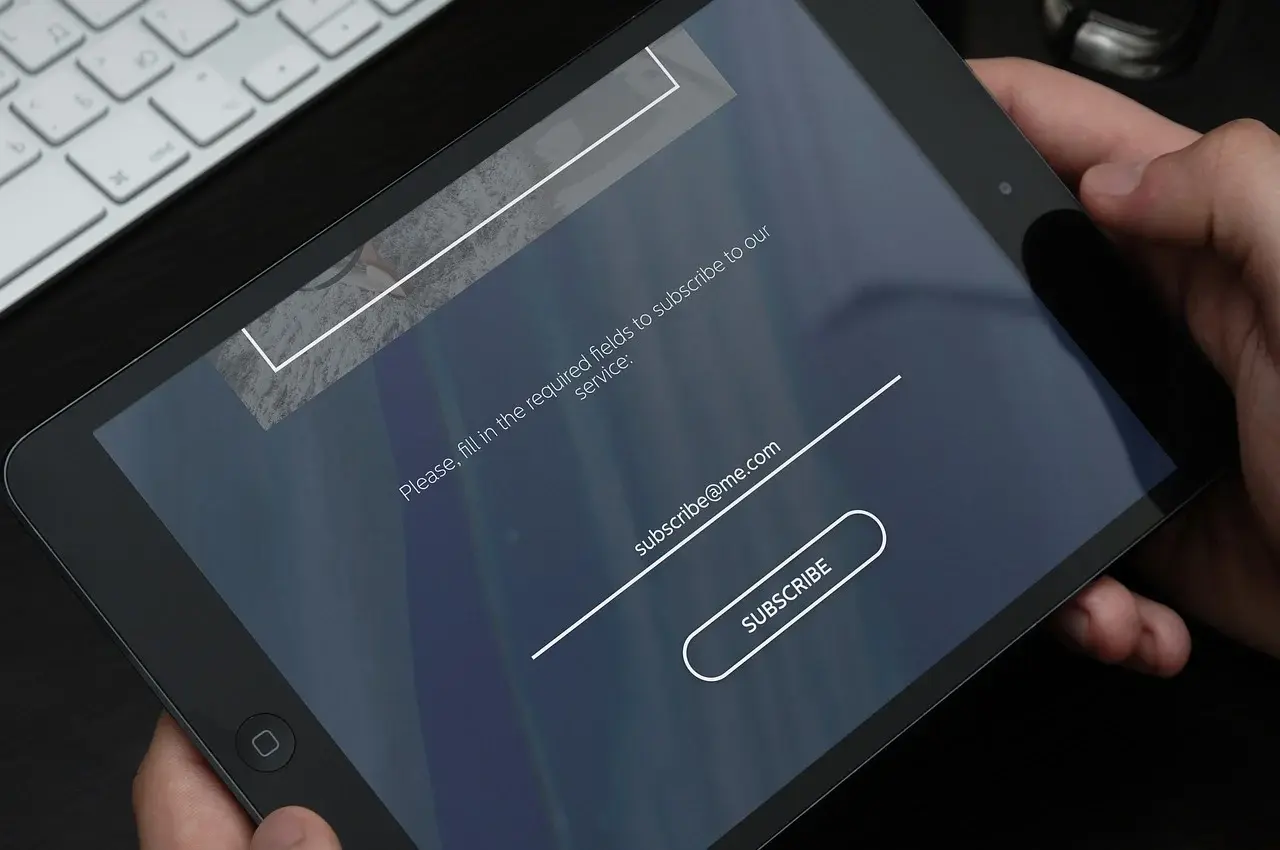

FULL ARTICLEA New Era of Subscription Payments: The use of VRP in Open Banking

Open banking is revolutionizing the payments' industry through the adoption of Variable Recurring Payments (VRPs), offering a range of advantages over traditional methods. VRPs stand to open up enormous opportunities for businesses and consumers, from intelligent savings and overdraft protection, to bill payment efficiencies and enhanced security protocols.

FULL ARTICLETransforming the Financial Industry with NLP-Powered Chatbots

The financial industry is rapidly adopting chatbots as a means of delivering fast and efficient customer support. Chatbots have proven to be cost-effective and efficient, allowing financial institutions to reduce their operational costs while still delivering a high level of customer service. However, the success of a chatbot largely depends on its ability to understand and respond to customer inquiries accurately. This is where natural language processing (NLP) comes in.

FULL ARTICLEIntegrating Blockchain-based Identity Verification in FinTech Apps

Identity verification is a process that plays an important role in the financial industry. It prevents fraud and the occurrence of money laundering. Conducted in the traditional way, identity verification posed quite a few inconveniences due to the cumbersome and time-consuming nature of the process. Among the requirements, it was necessary to provide detailed documentation and have a lot of control over the processes carried out by the verified entity.

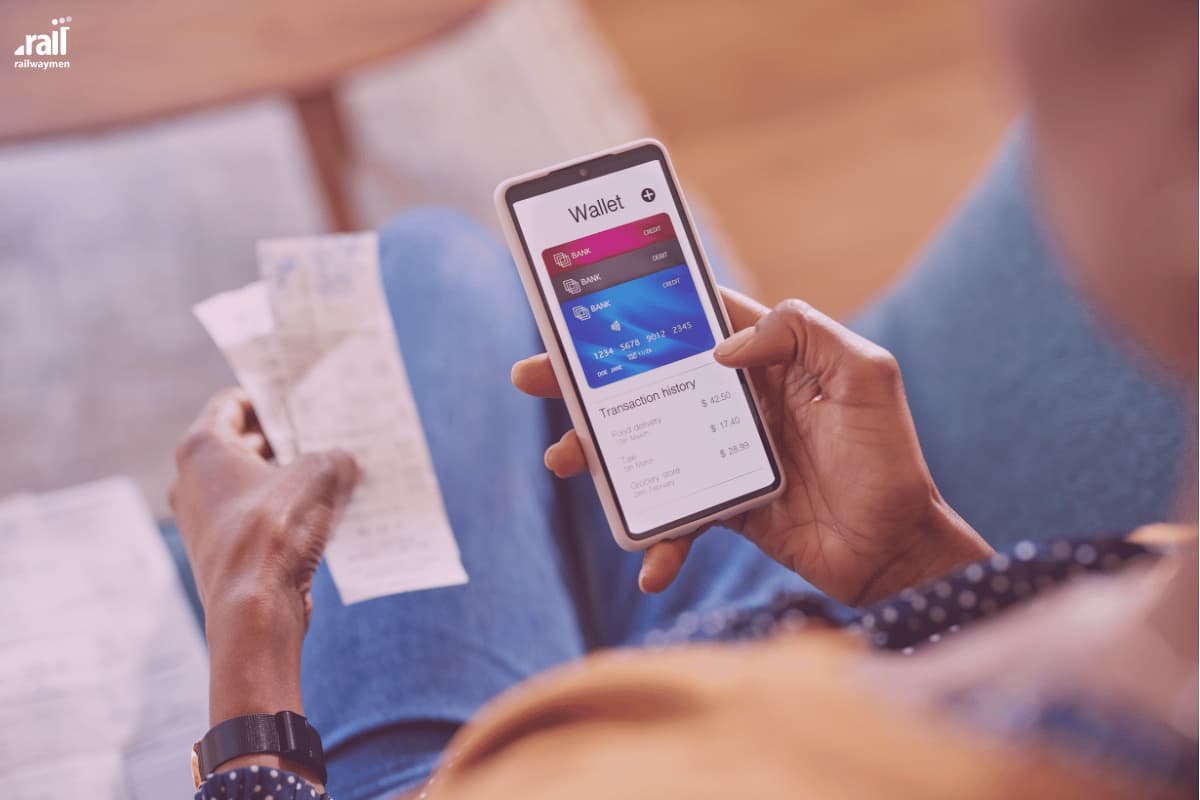

FULL ARTICLEMaximizing Financial Efficiency: Guide to Real-Time Budget Management

Managing budgets in real time can be a daunting task, particularly for businesses and financial teams that operate with multiple accounts, currencies, and permissions. This article will provide a comprehensive guide to the tools and software available to maximize financial efficiency and successfully manage budgets in real-time.

FULL ARTICLEUsing Blockchain for Secure and Transparent Payments in FinTech Apps

As the use of FinTech applications becomes more commonplace, many organizations are seeking to move beyond traditional methods of payments and look towards blockchain technology as a means to provide more secure and transparent payments.

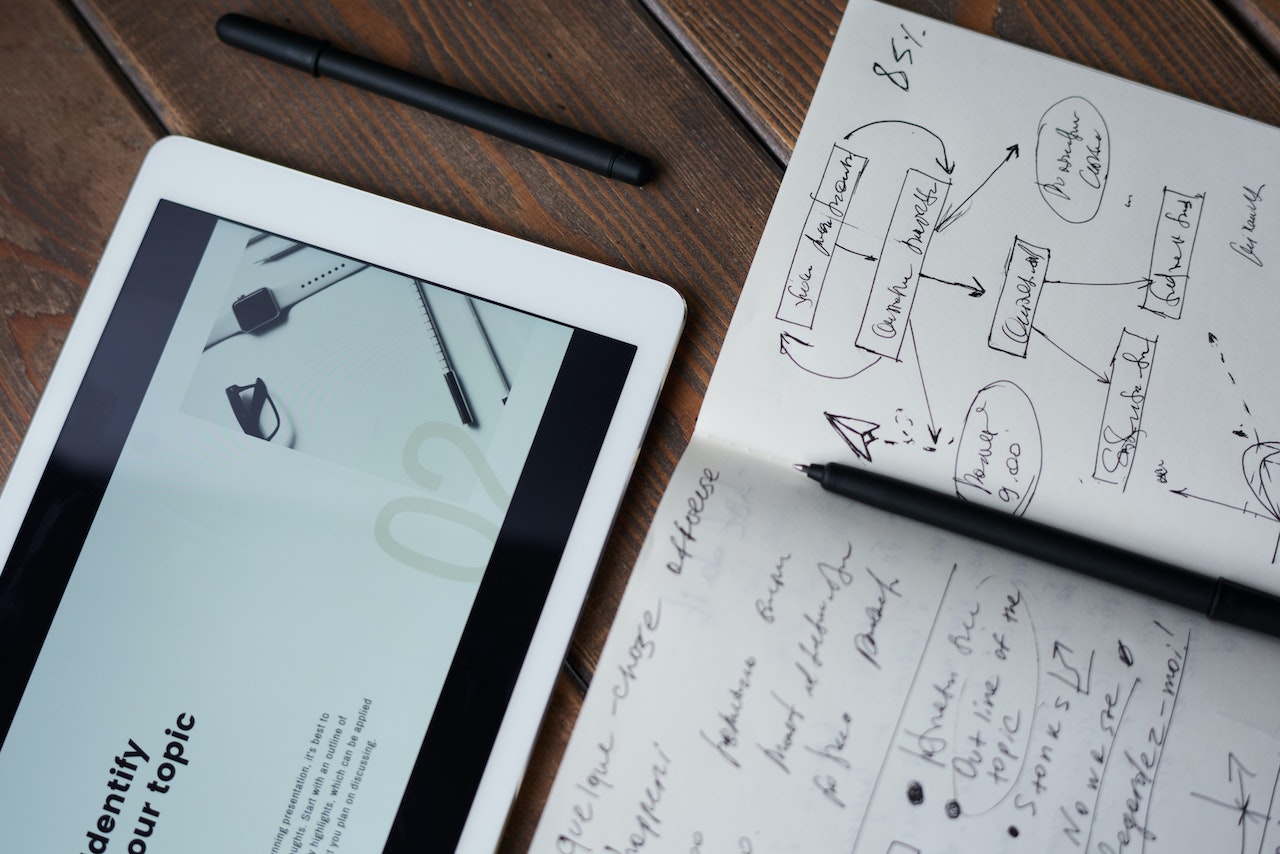

FULL ARTICLEHow to Create an Intuitive Interface for FinTech App?

Financial technology is an ever-growing industry that provides various services to customers, ranging from personal finance management to investing and trading. As FinTech continues to evolve and become more prevalent in our daily lives, creating an intuitive interface for financial apps is crucial to meet user's expectations and improving user satisfaction.

FULL ARTICLE